Worthy Bonds Review – Is It Right For Your Investing?

You won’t get rich by saving alone. In fact, you’ll actually lose money. Between inflation and extremely low-interest rates that max out at around 2% (if you’re lucky), the value of your saved cash actually decreases over time.

For these reasons, you have to start investing now. But investing is tricky. The Stock Market is volatile. Meanwhile, funds are less risky but navigating them can be challenging.

That’s why many people prefer bonds which are generally more stable and still provide a decent return. Enter Worthy Bonds.

Worthy Bonds makes it easy for anybody to get 5% annual interest on investments. It’s easy to use and costs as little as $10 to get started purchasing bonds.

What’s the deal with Worthy Bonds? Is it a good place to store your hard-earned cash? Discover what you need to know in this ultimate Worthy Bonds review.

What Is Worthy Bonds?

Worthy Bonds, a product of Worthy Financial, was founded in 2016 and is based in Florida. Worthy Bond’s founder, Sally Outlaw, is a registered investment advisor and the former CEO of the startup fundraising platform, Peer Backers.

In the year after its funding, Worthy Bonds generated $600,000 in seed capital and secured $1,000,000 in investments. Now, 10,000+ investors use the platform.

Worthy Bonds offers 36-month bond coupons sold in $10 increments. The bonds go to benefit small businesses and nonprofits looking to raise capital, who then make loan repayments, including interest, that eventually make its back to Worthy Bond’s bondholders. This is another thing that distinguishes Worthy Bond—they are explicitly anti-Wall Street and work on a peer-to-peer lending strategy.

You likely won’t use Worthy Bonds as your sole investment. It’s more of a complement to your existing strategy since you still want a diversified portfolio. Worthy Bonds accounts are also not FDIC-insured.

Still, all investments are a risk. And as far as risks go, Worthy Bonds is pretty secure. All bonds are backed by tangible assets, so there less concern about loanees defaulting. Overall, Worthy Bonds are a compelling alternative to more run-of-the-mill savings accounts.

How To Use Worthy Bonds

Setting up a Worthy Bonds account is relatively painless. But you do need to be ready to disclose some personal information including your Social Security Number, address, birthdate as well as link one of your financial accounts. All of these are required steps for making bond investments.

However, Worthy Bonds does keep all your data secure using 256-bit encryption (that means it’s super secure).

From here, you select your account type. The vast majority of users go for an individual account funded from personal bank accounts.

Unlike other financial apps like Acorns, there’s not much else to do on the site. You can set up recurring investments and a few other tools, but that’s about it.

This isn’t a bad thing. The whole point of Worthy Bonds is to be simple. Best of all, should you need to withdraw your money, you can do so any time without paying any fees.

The 5% Interest Rate

This is what will stand out the most to investors. 5% is a relatively high rate. With savings rates often between 1-2%, getting 5% is a virtual guarantee that your savings won’t get eroded by inflation.

Of course, there is a little risk here. Not only are these bonds not FDIC insured, but Worthy Bonds also hasn’t really weathered its first full recession yet. That doesn’t mean that either of these things could spell your investments automatically evaporating at the first sign of crisis, but it is something you should bear in mind.

Worthy Bonds Investment Limits

Worthy Bonds has two different investor types: accredited and unaccredited. Accredited investors exceed certain income thresholds and have a $50,000 bond limit. For non-accredited investors, the limit is up to 10% of net worth or annual income.

Accredited investors are those who have made $200,000 or more over the last 2+ years. Non-accredited is everybody else.

Risk Mitigation

It is easy to go blind once you see that Worthy Bonds are not FDIC-insured. But they literally cannot be FDIC-insured since they are not a bank.

Worthy Bonds does do what it can to reduce your risk despite this. To start, Worthy Bonds are asset-backed through the borrower’s inventories. If a loan default does occur, inventories are sold off to recover amounts.

Worthy Bond is also SEC-registered.

Worthy Bonds Loose Change Investing

You can directly purchase Worthy Bonds online or via their mobile app. Everything is easy and intuitive.

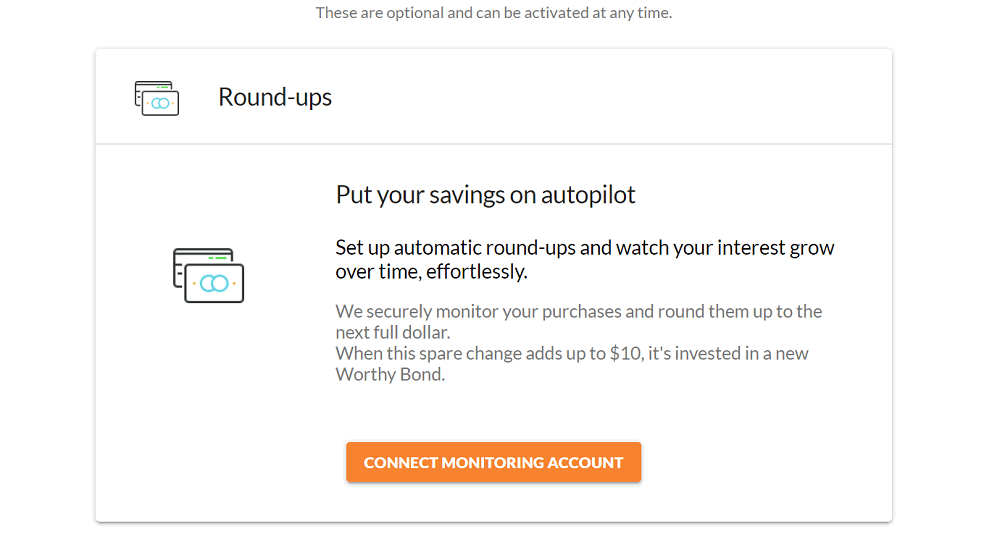

One of the cooler features of Worthy Bonds is you can invest loose change from credit and debit card purchases. For example, if you purchase a coffee for $3.75, you can have Worthy Bonds invest the other $0.25. Once you reach $10, Worthy Bonds can automatically purchase another bond for you.

You can also set up Worthy Bonds to make automatic recurring investments making it a great way to set your investing on autopilot.

Who Should Use Worthy Bonds?

There’s a lot to love about Worthy Bonds required of whether you have $1,000,000 or $1,000 in the bank. Anybody looking to get a pretty decent return with an acceptable amount of risk should consider.

Overall, Worthy Bonds is well-suited for these types of people:

- Those who want a better return than standard savings accounts

- People who want a hands-off approach to investing

- Those interested in liquidity

- Relatively short terms – 36 months

- Investors who want to diversify their portfolio

Is Worthy Bonds Worth It?

Worthy Bonds have no monthly fees. The only you pay for is the bond itself, and you can get started with just a $10.00 investment.

Compared to other investment opportunities, this is quite a steal! For example, Acorns is one of the leading “roundup” investment platforms out there. But fees on it range between $1-3 a month. While in the grand scheme of things, this might not be very much, it can be a considerable percentage of assets for people with lower balances.

With such a low investment threshold, give it a shot. Try $10-100 if you’re unsure. You can always fund the account with more money if you think it’s a good option for you down the road.

Worthy Bonds Alternatives

It depends on what you’re looking for. If you want security, then you can opt for a “High yield” savings account. Or you can go with a robo-advisor or peer-to-peer network.

High Yield Savings Account

We’ll be direct, “high yield” is something of a joke. As of this writing, the highest APY offer out there is hovering around 0.91%. That means if you invest 00, you’ll end up with $1009 by the end of the year.

Of course, things are a bit more complicated than that. There may be account fees and minimums as well as account opening bonuses.

Overall, you’ll be lucky if you come out with a tiny bit more than you put it. But they are safe and certainly better than letting your money sit in a checking account where you automatically lose the battle against inflation.

Acorns

We’ve already mentioned Acorns a few times in this review. If you want an easy way to start investing, then this is definitely it. Acorns was one of the first platforms to introduce roundups and recurring investing. And similar to Worthy Bonds, you can withdraw your funds at any time.

The difference, however, is the approach to investing. Acorns invests in a range of bonds and stocks via its algorithmic robo-advisor tool based on your risk assessment (from conservative to aggressive).

Acorns has a larger range of financial tools available as well as more features like Found Money which helps you to get even more ROI from the platform.

You do have to pay a monthly fee starting from $1/month to use Acorns, but as your assets increase over time, this will be pretty negligible.

Overall, Acorns and Worthy Bonds are complementary services. Since they both are low investment, you can check them out and use both of them to diversify your portfolio.

Worthy Bonds: The Final Verdict

Worthy Bonds is an excellent place for people to directly invest in bonds without paying any fees and getting a fairly sizable return. If you’re looking for a relatively low-risk investment with a short fixed-term and zero fees for early withdrawals, then don’t miss out on Worthy Bonds!

Pros

- High interest rate compared to savings account

- Very low investment to get started

- Easy to use

- Recurring investing and roundups turn investing on autopilot

- Risk is fairly

- Cannot see your investment portfolio

- Bonds support small businesses

- Anybody can invest

- Includes tax-advantaged account options

- Good way to diversify your portfolio

- Very liquid, you can withdraw money anytime

Cons

- Not FDIC insured so there is some risk

- Limit on investments

- Not recession tested (yet)

- Doesn’t sell corporate or government issued bonds

- Not the most competitive investment

- Would be nice if they had some other financial management tools packaged in